Do you care for your elderly parents? If so, you could be eligible for Carer’s Allowance. This is a government benefit that supports people who provide unpaid care.

Caring for your parents can be very rewarding, but it can also place a strain on your finances. That’s why it’s so important to claim any support that you can. In this simple guide to Carer’s Allowance, we’ll explain how you qualify and how much you could receive.

What is Carer's Allowance?

Carer’s Allowance is a taxable benefit available to anyone over 16 who provides continuous care to another person. Many people may not think of themselves as a carer. However, you probably are if you regularly care for a loved one. In fact, there are more than 1.4 million people providing unpaid care every week in the UK.

The Carer's Allowance benefit was introduced in 1976 and is designed to operate as an ‘income replacement’ benefit. It is intended to aid with living costs for people who cannot work full-time due to their caring responsibilities.

This is an important benefit to consider applying for; 600 people give up work every day to care for their loved ones. Plus, more than a third of carers claim they are or have been in debt. Carer’s Allowance could help alleviate these worries by covering the cost of equipment and other monthly expenses.

Can I Claim Carer's Allowance?

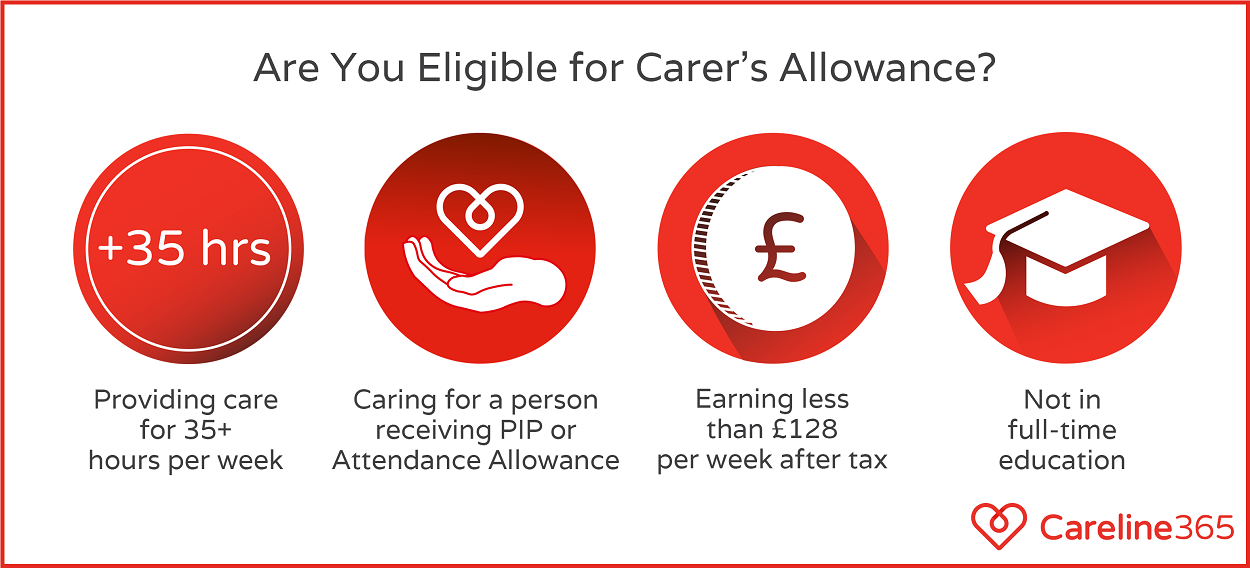

You could be eligible for Carer's Allowance if you meet the following criteria:

- You spend at least 35 hours per week caring for someone.

- The person you care for receives Disability Living Allowance (DLA), Personal Independence Payment (PIP), or Attendance Allowance.

- You don't earn more than £151 per week after tax.

- You aren't in full-time education.

Despite what you may assume, you don't have to be related to the person you're caring for in order to claim Carer's Allowance. It could be your elderly parent(s), another relative, a friend, or a neighbour.

However, it is important to remember that if you provide care to more than one person you can only make one application. You must be providing at least 35 hours of care to one of the people you are caring for. Similarly, if more than one person is providing care to the same person, only one of you can apply for Carer’s Allowance.

How Much Could I Get?

The rate of Carer's Allowance changes every tax year (from 6 April one year to 5 April the next year). For the 2024/25 tax year, the rate has been set at £81.90 per week.

If you receive any other benefits, claiming Carer's Allowance for looking after elderly parents could affect how much you receive.

For example, you cannot receive the full amount of both Carer's Allowance and the State Pension. If the amount you receive from your State Pension is more than Carer's Allowance, you won't receive any Carer's Allowance money. However, if your State Pension is less, you'll get the difference paid in Carer's Allowance.

This extra amount is called a Carer's Premium or Carer's Addition. We know that these rules can be quite complicated, so we would recommend contacting your local Citizens Advice centre for more information.

However, even if you can't receive any money from Carer's Allowance, it's still worth making a claim as you can be awarded an 'underlying entitlement'.

Underlying Entitlement

This term essentially means that you meet the criteria for Carer's Allowance but you cannot receive the money as it overlaps with another benefit e.g. State Pension. However, this can still be a helpful thing to have. An underlying entitlement can increase any means-tested benefits you already receive or help you qualify for other means-tested benefits for the first time.

Remember, means-tested benefits will depend on your income and savings (as well as your partner's income and savings, if applicable).

How To Claim

If you want to claim for caring for your elderly parents, there are a few ways to apply. You can use the government's online form by clicking here.

Alternatively, you can apply by post – you'll need to print off a paper form and fill it in. Click here to download and print the relevant forms.

While you cannot apply by telephone, you can call the Carer's Allowance Unit on 0800 731 0297 for help with your claim.

What If I Don't Qualify?

If your application is not successful, you have a few options. You may wish to ask for a written statement of the reasons behind their decision. You will then be able to use this as evidence when you request a 'mandatory reconsideration'.

This is the first step of the appeal process. It gives the benefits office the opportunity to review the reasons behind the original decision and reconsider. To request a mandatory reconsideration, you'll need to write to the address on your original decision letter. You should include the reasons why you think the decision is wrong as well as any evidence to support your claim.

Be sure to submit this request as soon as possible after receiving the initial decision – there should be a deadline on your original decision letter.

You'll then receive a mandatory reconsideration notice in the post. This will tell you whether your claim has been granted or denied. From there, you'll usually have up to one month to appeal the decision. Click here to submit an appeal or learn more about the appeals process.

Other Benefits

If you are caring for an elderly parent, Carer's Allowance is there to support you. There are also other benefits which you and your parents may be able to claim.

For more information, read our helpful guide to benefits for elderly people.

Alternatively, you can read our individual articles on benefits you can receive:

However, keep in mind that other benefits may impact or be impacted by the amount of Carer's Allowance you receive.

How Careline Can Help

When you provide regular care to a loved one, it is natural to worry about their wellbeing. It is an unfortunate truth that you cannot always be there to assist them. This may leave you anxious about leaving them on their own, and respite care isn’t cheap.

A Careline Alarm may be the solution. By purchasing a personal alarm, your loved one will be connected to our 24/7 Care Team. This allows them to request support at any time.

When your loved one activates their alarm by pressing their pendant alarm button, they will be put through to our Care Team. They will speak with your loved one to determine the nature of the emergency. If necessary, we will also alert the emergency services.

The next step will be to inform you and any other emergency contacts. This means that you can be made aware that they need help no matter where you are.

As such, you can count on our personal alarms to provide extra peace of mind when you are providing care.

For additional reassurance, our Fall Detector and GPS products come with a range of additional benefits.

A Fall Detector Alarm is automatically activated if your loved one has a fall. Our team will follow the same procedure as if they activated it manually, meaning you will be immediately informed.

Alternatively, if your loved one may require assistance outside of their home, then a GPS Alarm is a wise investment. Unlike our other alarm packages, the GPS alarm is not limited by a base unit. Instead, it uses a mobile connection to ensure it can always alert our team.

This means you can feel reassured knowing support is on hand. A Careline alarm can also improve your loved one’s peace of mind if they are temporarily unattended.

To find out more about the Careline alarm service, or to place an order, get in touch with our friendly team today on 0800 030 8777. Additional information can be found in our guide to the alarm service, and you can find more helpful articles like this by checking out our blog.

Order Your Careline Alarm Online Today

Editor's Note: This article was updated on 5th June 2024 to reflect current information.

Choose Your Personal Alarm

To help you choose, start by selecting where you would use your personal alarm. In home only or at home and on the go.

Hi,I am moving into my mum’s house to be her live in carer as she is now house bound.I have left my employment to look after mum full-time.Am I entitled to carer’s allowance?. Thanks.

Hi Nigel,

If you meet the criteria outlined in the article, you will be eligible for Carers Allowance. The criteria are:

You spend at least 35 hours per week caring for your mum.

Your mum receives Disability Living Allowance (DLA), Personal Independence Payment (PIP), or Attendance Allowance.

You don’t earn more than £128 per week after tax.

You aren’t in full-time education.

We hope this has helped.

Kind regards,

Careline365

my mum is 85 and only gets her private pension and state pension. i work full time, but spend at least 10 hours a week with her as she is now housebound. Am i entitled to claim any carers allowance. My brother visits on the days i am unable to go.

Hi Sharon,

Unfortunately, carers allowance is only available for carers who provide at least 35 hours of care a week.

We hope this has helped.

Kind regards,

Careline365

I care for my elderly mother in law I get carers allowance. I help her shower dress personal hygiene needs get meals prepared for her. I do her washing and drying and general household cleaning. However she is saying I must do more cleaning eg clean skirting boards windows scrub floors etc. what are my rights to these extra jobs. Can I refuse to do them. Would I lose the allowance if I say no.

Hi Lynne,

Your carers allowance shouldn’t be affected if you refuse to do these extra jobs for your mother-in-law. This sounds to us more like a personal matter and something to discuss with her. As long as you are providing the 35 hours of care a week to be eligible for carers allowance, though, you should continue to receive it unless your mother-in-law refuses to accept your care.

If you have any further questions, we would recommend speaking to Citizens Advice.

We hope this has helped.

Kind regards,

Careline365

I care for both of my 90 year old parents. One has dementia and the other has Parkinson’s and is in a wheelchair. Whilst I understand I cannot receive 2 Carers allowance payments, the helpline has told me I must chose one of them to claim the allowance for and base my application on that person. Then, if and when that person passes away I must start a new claim for the other remaining relative. Surely that is not fair for those of us caring for 2 parents and creates extra work for Carers and the government departments? And how do I decide which one to claim for when my time is spent equally caring for both?

Hello Miss M,

Thank you for your comment. It is regrettable that the government do not make it fairer to claim Carers Allowance when you have two parents in need of support. As they have advised you choose one to claim for, we would recommend claiming for the parent you feel requires the most support, as this may improve your chances of a successful application. We wish you and your parents all the best.

We hope this has helped.

Kind regards,

Careline365

If I get pension credit quarantined, will it effect my money if my daughter claims carers allowance, also my benefit for housing and council tax reduction

Hello Jackie,

Thank you for your comment. Your daughter’s Carers Allowance and your housing and council tax benefits should not be affected by Pension Credit.

We hope this has helped.

Kind regards,

Careline365

i look after my elderly parents mum has Alzhimers and my dad is recovering from a fracture in his leg . so we have a bed downstairs ive just been turned down for PIP because i have some health issues my father is worried that if i try to claim some kind of allowance or benefit it will affect theirs, its been a stressfull house just latelyas mum gets more fragile we have family popping in regular, so that helps i think my dad gets something for helping i dont know because when it comes to finance my dad is very private, i mentioned a few things to him and he was worried if i try and claim something it will affect mums money and his money whatever they receive , just wondered if you could give me some advice mum and dad are 84 , i am 61

Hello David,

Thank you for your comment.

Whether any benefits you receive affect your parents’ would depend on the benefits they are in receipt of. We are assuming you are living with them. However, Carer’s Allowance shouldn’t affect the benefits they receive unless your dad is already receiving Carer’s Allowance for looking after your mum. However, if you don’t know what benefits your dad is receiving, this may make it difficult to apply for any yourself. We would advise getting a full list of benefits your mum and dad are receiving and then asking Citizens Advice to help you identify any additional benefits you may be eligible for.

We hope this has helped.

Kind regards,

Careline365

Hi i currently get carers allowance for looking after my dad,he went into hospital a few weeks back after a fall and now has carers coming out to see if he needs any more care,hes been given a few items to help him.The carers basically just give him his tablets and ask him if he needs anything. My role hasnt changed as im still caring for him,myself too with his daily needs,my question is what will happen to my carers allowance, will it change at all,thanks clare

Hello Clare,

Thank you for your comment. Having carers visit should not affect your eligibility for Carer’s Allowance. Provided you are still providing care for at least 35 hours per week, your payments should not change.

However, if you are not sure, we would recommend asking Citizens Advice.

We hope this has helped.

Kind regards,

Careline365

Hi my father receives state pension and attendance allowance. He has recently just been awarded pension credit if I apply for carers allowance will it effect any of his income

Hello Diane,

Thank you for your comment. Carer’s Allowance is a benefit for the person providing care, so will not affect the income of the person who requires care. The money goes to you to help you with the costs of living whilst you are providing care.

We hope this has proved useful.

Kind regards,

Careline365

I have just been refused it due to being the son (caring for my Mother). Some places say being a child disqualifies you, other like this site speak about it as if that is not a problem

Hello Stuart,

Thank you for your comment. Carer’s Allowance is only available to people over the age of 16 who provide at least 35 hours of care a week to someone else. You also cannot be in full-time education or studying for more than 21 hours a week. If you feel you have been unfairly refused, you can request a Mandatory Reconsideration.

We hope this has helped.

Kind regards,

Careline365

Thank you very useful

Hi,

I was considering applying for carers allowance for my mum, not sure if my sister in law is already claiming it, just checking before I complete any forms.

If you could advise please.

Lisa

Hello Lisa,

Thank you for your comment. Only one person providing care for your mum can claim Carer’s Allowance. You will only be able to claim if no one else is claiming it already. We advise asking your sister-in-law whether they have made a claim before making one yourself. If they have not claimed Carer’s Allowance, you may be eligible.

We hope this has helped.

Kind regards,

Careline365

My mum has alzheimers, and is now at the point where I am caring for her well over 35 hours per week. I currently work too, so this is putting a lot of strain and stress on myself. Am I able to give up work to look after my mum full time, and still apply and claim for Universal credit, as the pittance of £69.60 per week, would not be enough to cover our bills, my travel costs, let alone put food on our table too. My mum receives just a state pension and pension credit, my spouse is also in receipt of a state pension only. Any advice would be greatly appreciated.

Hello Mark,

Thank you for your comment. We understand that times are tough right now, especially for people in your circumstances. As yours is a complex situation, we would recommend contacting Citizens Advice for advice specific to your circumstances.

We hope this has helped.

Kind regards,

Careline365

I have a joint claim with my fiance, for Universal Credit because our business ended due to Covid. My mother was in hospital last year and needed helping to walk again and help getting up and down the stairs, getting in and out of the bath, cooking, cleaning and shopping etc. My dad helps where he can but he is diabetic and aches a lot himself and is tired all the time. I have not claimed for carers allowance yet as I was led to believe that its the same amount as Universal Credit so there is no point. Universal Credit is also paying part of the interest on my interest only mortgage and I don’t know if this would change if I changed benefits. I am now being harassed by UC to look for work and I’m worried about my parents being able to care for themselves.

My questions is.. if I claim carers (I’m easily there or shopping for them at least 35hours a week) allowance so I can keep caring for my parents, will my mortgage SMI loan still be paid to my mortgage company? to do this will I need to or be able to claim UC for 5 hours a week? how would this work for me.

Thank you

Hello Lotty,

Thank you for your comment. If you are providing care to your mother for at least 35 hours a week, you may be eligible to receive what is called a “carer addition”. This is extra money on top of your universal credit allowance. We regret to say that we do not have any information on whether your mortgage SMI loan will still be paid; Citizens Advice may be able to answer this question.

We hope this has proved useful.

Best wishes,

Careline365

My mum has difficulty walking and becos of that I do all her cleaning washing shopping and helping her bath I spend roughly 15 hrs every week doing for my mum im employed part time also wud I be able to claim for helping my mum

Hello Mrs Miles,

Thank you for your comment. Unfortunately to apply for Carer’s Allowance you need to provide at least 35 hours per week caring for your loved one. However, if your mum needs support, she may be able to apply for Attendance Allowance. You can find more information on our blog post.

We hope this has helped.

Best wishes,

Careline365

Im just getting to be a carer for a lady she is on pip but will get pension from june. Will i still get the carer allowance or should i apply anything else??

Hello Richard,

If the person you are caring for is receiving State Pension, this should not affect your entitlement to Carer’s Allowance. This is because Carer’s Allowance is designed to support your income, not that of the person you are caring for. They may, however, be entitled to Attendance Allowance. If you are uncertain, you can get in touch with Citizens Advice for additional information.

We hope this information has proved useful.

Best wishes,

Careline365

Ive had to leave my job to care for my mom and im ther every day from 8 till 6ish each day can i claim anything as my mom is on disability allowance andni dont want anyrhing to effect her money. Any help would be greatlyappreciated as i lost my dad who used to care for mom but now im doing it

Hello Emma,

Thank you for your comment. If you are providing care for more than 35 hours per week, you can claim Carer’s Allowance. This will not affect the amount of money your mum receives. However, if your mum is in a position where she requires additional care, she may be able to claim Attendance Allowance.

We hope this has proved helpful.

Best wishes,

Careline365