If your loved ones are on a low income and need monetary support, Universal Credit could provide help with their living costs. With bills rising across the country, more and more people are in need of a helping hand. If they are eligible, Universal Credit could help your loved ones’ money go a little bit further each month.

What is Universal Credit?

Universal Credit is designed to help people of all ages, circumstances, and backgrounds with their monthly living costs. It is a non-taxable benefit that is based on your income, savings, and investments.

This wide reaching benefit was first introduced in 2013. It was created to roll Child Tax Credit, Housing Benefit, Income Support, Jobseeker’s Allowance, Employment and Support Allowance, and Working Tax Credit into a single system.

Can I Claim Universal Credit?

Due to the variety of benefits available under the Universal Credit umbrella, the eligibility requirements are quite simple. The person claiming must:

- Live in the UK

- Be aged 18 or over

- Be under State Pension age

- Have less than £16,000 in savings or investments

There are exceptions regarding the age of eligibility. If a person is 16 or 17, they may still be able to claim Universal Credit if they meet one of the following additional criteria:

- Have medical evidence of a health condition or disability

- Are caring for a severely disabled person

- Are responsible for a child

- They are pregnant and expecting their baby within 11 weeks

- Have had a baby in the last 15 weeks

- Do not have parental support and are not under local authority care

How Much Could I Get?

The amount received under Universal Credit is based on specific circumstances. Every claimant gets a standard allowance that is either added to or deducted from when circumstances are applied. Circumstances are assessed monthly and affect the whole assessment period.

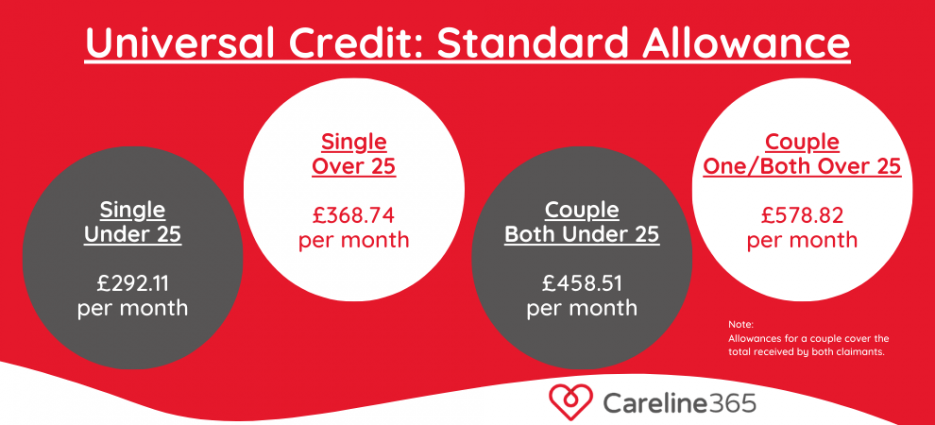

Standard Allowance

- Single person under 25: £292.11 per month

- Single person aged 25 or over: £368.74 per month

- Couple where both people are under 25: £458.51 per month (for both)

- Couple where at least one person is aged 25 or over: £578.82 per month (for both)

You will also receive an additional amount for children. If your first child was born before 6th April 2017, you could receive up to £315. After this date, your first child is eligible for £269.58. The same amount applies to your second and subsequent children. This is increased by a further £146.31 or £456.89 for disabled or severely disabled children, respectively.

If the applicant has a disability or health condition that affects their capability for work, they could receive an additional £390.06 per month. Claimants who care for a severely disabled person for at least 35 hours a week are eligible for an additional £185.86 per month.

People who claim Universal Credit may be able to get help with housing costs and interest payments. How much depends on age and specific circumstances. Other financial support may also be available to Universal Credit claimants.

Deductions

If your loved ones are employed, for each £1 they earn 55p will be deducted from their monthly Universal Credit payment.

People responsible for a child, or who have a health condition or disability that affects their ability to work, may be eligible for a ‘work allowance’. A work allowance is the amount of money that can be earned before deductions are taken from Universal Credit payments. If your loved one gets help with housing costs, their work allowance will be £379. If not, £631 will be the amount they can earn before their payment is reduced by any income.

How to Claim?

Universal Credit is claimed online. If your loved one lives with a partner, both must make an account and start a joint claim. If the claim isn’t completed within 28 days, they will have to start the process over again. You can start the claim process on the official government website.

You can also start the claim process via phone by calling the Universal Credit helpline on 0800 328 5644.

Read More: How to Claim Universal Credit

What If I Don’t Qualify?

If a decision is made about the claim that you or your loved one disagree with, you have the right to challenge it. This is called mandatory reconsideration.

When mandatory reconsideration is requested, the Benefits Office are given the opportunity to assess any new supporting evidence and reconsider their decision. Before asking for mandatory reconsideration, you should find out in writing why the claim was unsuccessful. Using this information, you can provide evidence that helps to support the claim that might have been missed the first time.

More Useful Benefits

While Universal Credit encompasses many different benefits, you could be entitled to further financial support. For more information, read our guide to benefits for elderly people.

Alternatively, read our individual guides to different benefits:

However, be aware that some benefits may impact the amount of Universal Credit you are entitled to.

Careline365 Can Help

Another way to support your loved one’s independence and safety is to consider a Careline alarm. A personal alarm enables them to request help at the simple press of a button. This sends an alert through to our Care Team, who then inform your loved one’s emergency contacts that help is needed.

Our team are available 24/7, 365 days a year. They are always on hand to support you and your loved one, day and night. You can rest assured that they will do all they can to get your loved one the help they need.

Furthermore, we provide a range of devices to support wellbeing at home. Our Fall Detectors activate automatically if your loved one has a fall. This allows our team to arrange help even if your loved one cannot press the button themselves. Moreover, we offer a GPS Alarm, providing peace of mind wherever your loved one goes. It also comes with a built-in loudspeaker, ensuring your loved one can always speak to our team.

To find out more about the Careline alarm service, read our helpful guide. If you have any questions, get in touch with our team on 0800 030 8777.

Editor’s Note: This article was updated on 20th February 2024 to reflect current information.

Choose Your Personal Alarm

To help you choose, start by selecting where you would use your personal alarm. In home only or at home and on the go.

Leave a Reply